Electronic invoices are to become mandatory in the B2B sector from January 1, 2025. This is according to the Growth Opportunities Act passed by the Federal Cabinet. Until now, electronic invoicing has only been mandatory for suppliers and service providers to the federal government. Now it is also to become mandatory in the B2B sector in order to further promote digitalization in this area. The introduction of e-invoicing promises companies cost savings, efficiency gains and greater transparency. However, like any change, it also brings minor challenges. In this article, we show you what you need to know about e-invoicing and how you can master the transition without any problems.

E-bill - what is it actually?

The term "e-bill" can quickly lead to misunderstandings. In common parlance, "e-invoice" is used for many forms of invoices. It is used both for purely visual representations, such as scanned paper invoices or a PDF document, as well as for exclusively structured data formats.

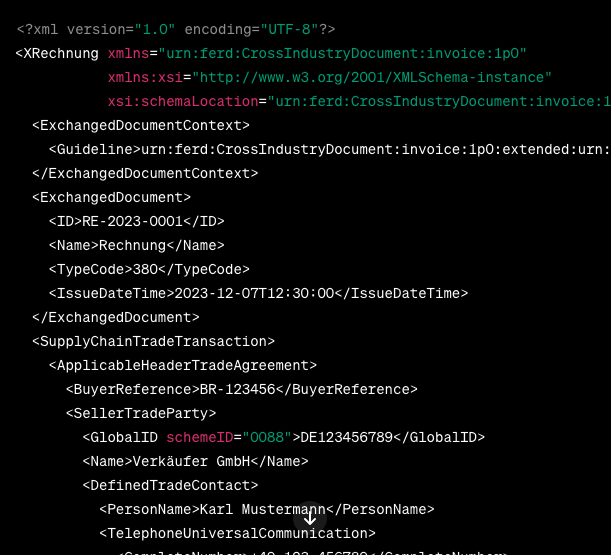

What an e-invoice actually is is defined in a European Union standard (EN 16931). According to the EU standard, an e-invoice differs from a scanned paper invoice or an invoice in PDF format in that it is structured, machine-readable and can be processed directly without media discontinuity. An e-invoice is a semantic data format based on the XML standard. This was specially developed for machine processing and can only be read by humans with the help of a visualization program.

What standards are there for e-invoices?

There are now several standards that meet the requirements of the EU standard for electronic invoicing. The XRechnung standard was developed by the Coordination Office for IT Standards (KoSIT) on behalf of the Federal and State IT Planning Council. It is a binding national standard that is used in the federal administration.

In addition to the XRechnung standard, there is also the ZUGFeRD standard. ZUGFeRD stands for Zentraler User Guide des Forums elektronische Rechnung Deutschland. It is a standardized format for electronic invoice exchange that was developed by the Forum elektronische Rechnung Deutschland (FeRD) in cooperation with the Federal Ministry for Economic Affairs and Energy. It offers the great advantage that it can be used across the board, i.e. both for public administration and for companies in the private sector - worldwide.

ZUGFeRD is a hybrid data format in which structured invoice data in XML format is integrated into a PDF document (PDF/A3). The image file and the machine-readable invoice data are therefore available together in a ZUGFeRD invoice. However, it is also possible to create ZUGFeRD invoices as purely structured XML files, i.e. without the PDF document visualizing the invoice data.

How can e-invoices be created securely?

There are various ways to create e-invoices. There are now several specialized websites where e-invoices can be created using a generator. However, this option is unsuitable for companies that regularly create e-invoices, as it is time-consuming and makes proper accounting more difficult. There is also a risk that the generators are not updated regularly and do not meet current legal requirements.

It is therefore advisable for companies to use modern finance and accounting software that can be used to create and store e-invoices (XRechnung, ZUGFeRD) in a legally compliant manner. You no longer have to worry about compliance with data protection (GDPR) and retention obligations (GoBD).

What advantages do e-invoices offer?

There are many good reasons for companies to switch to electronic invoicing, as it offers numerous advantages:

- Cost reduction: E-invoicing eliminates the costs of sending, receiving and processing invoices. The time-consuming and expensive process of creating and sending paper invoices is no longer necessary. Employees who were previously responsible for invoicing gain more time and can focus on other tasks. Recipients also benefit from e-invoices, as the manual processing of incoming invoices is no longer necessary as they can be automatically transferred to the finance and accounting tool for further processing.

- Shorter throughput times and faster invoice paymentAs a rule, payment periods begin with the receipt of an invoice. E-invoices reach their recipients immediately after they are sent, which enables earlier and timely payment.

- Error prevention: Because invoicing and processing can be almost completely automated with financial and accounting software and manual intervention is largely eliminated, input errors are much less frequent.

- Secure archivingIn Germany, companies are legally obliged to keep their invoices for a period of 10 years. If invoices are issued and stored in paper form, a separate archive room is quickly required for this purpose. If there is a fire or water damage in this room, this can quickly mean the loss of all invoice documents. Such a loss can be quite expensive for the company. If, on the other hand, invoices are stored electronically in a finance and accounting system, they are not only stored in compliance with data protection regulations and in accordance with the legal requirements for the proper keeping and storage of books (GoBD), but are also very well protected against loss by backups and data mirroring. Digital archiving also has the advantage that invoices can be searched for and found quickly and are also better protected against unauthorized access.

When should you switch to e-billing?

The advantages that e-invoicing offers companies alone are sufficient incentive to introduce it quickly and not wait until the last minute. Although the Growth Opportunities Act passed by the Federal Cabinet provides for various transitional periods during which it will still be possible to use paper invoices in the B2B sector under certain conditions, those who decide to introduce them now will ultimately save time, money and, above all, nerves. If you want to make the switch, it is worth comparing different financial and accounting tools with each other first. We will of course be happy to advise you and support you with the introduction of software in your company. Simply book a free consultation with one of our experts.